FMZ量化交易工欲善其事必先利其器-学习使用研究环境分析交易原理

目前不清退的交易所推荐:

1、全球第二大交易所OKX欧意

国区邀请链接: https://www.myts3cards.com/cn/join/1837888 币种多,交易量大!

国际邀请链接:https://www.okx.com/join/1837888 注册简单,交易不需要实名,新用户能开合约,币种多,交易量大!

2、老牌交易所比特儿现改名叫芝麻开门 :https://www.gate.win/signup/649183

全球最大交易所币安,国区邀请链接:https://accounts.binance.com/zh-CN/register?ref=16003031 币安注册不了IP地址用香港,居住地选香港,认证照旧,邮箱推荐如gmail、outlook。支持币种多,交易安全!

买好币上KuCoin:https://www.kucoin.com/r/af/1f7w3 CoinMarketCap前五的交易所,注册友好操简单快捷!

FMZ量化交易平台邀请链接:https://www.fmz.com/

工欲善其事必先利其器-学习使用研究环境分析交易原理

在量化交易、程序化交易领域“对冲”这个词汇可谓是非常基础的概念,在数字货币量化交易中,经常使用到的对冲策略有:期现对冲、跨期对冲、现货对冲,其本质都是对于差价的交易。可能说到对冲这个概念、原理、细节,很多刚踏入量化交易领域的同学还不是很清楚,没关系,下面我们一起使用发明者量化交易平台提供的「研究环境」这个工具,一起来轻松的学习、掌握这个知识。

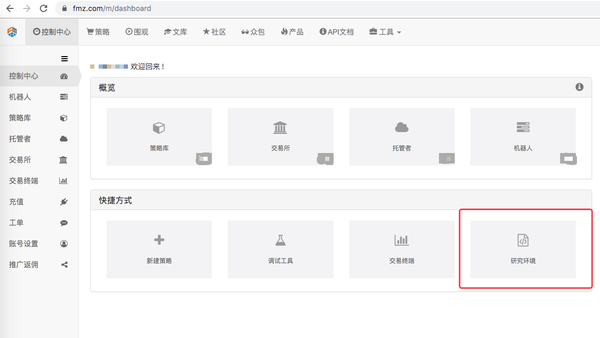

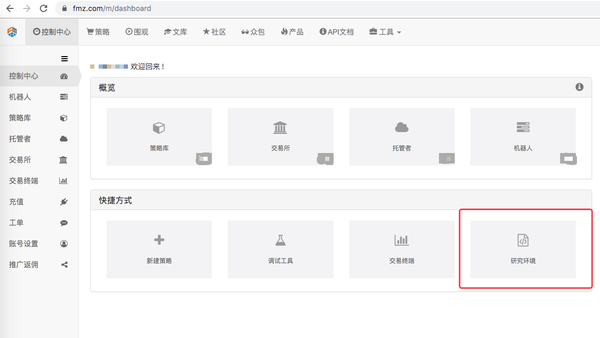

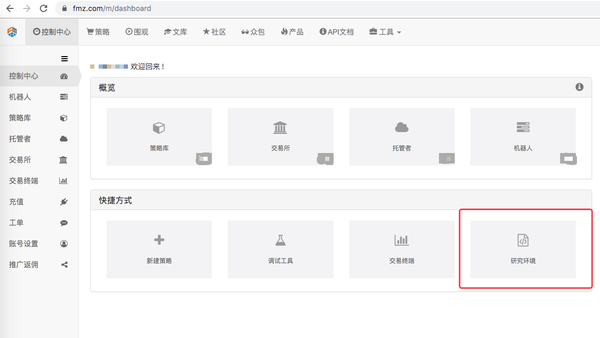

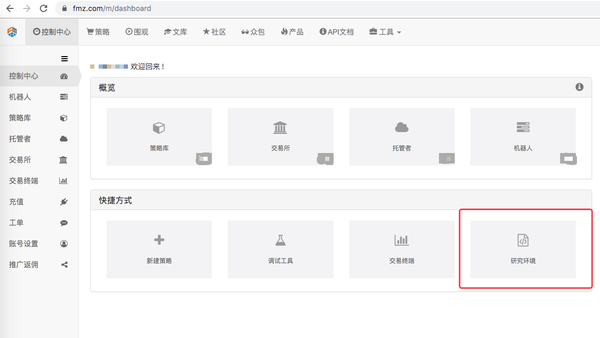

在发明者量化的控制中心,点击「研究环境」就可以跳转到这个工具的页面:

这里我直接上传了这个分析文件:

这个分析文件是对于回测时的一次期现对冲开仓平仓做的过程分析,期货交易所为OKEX期货,合约为季度合约quarter。现货交易所为OKEX币币交易,交易对为BTC_USDT,分析期现对冲操作流程的,可以看下面具体研究环境文件,写了两个版本,一个Python语言描述,一个JavaScript语言描述。

-

研究环境Python语言文件

期现对冲原理分析.ipynb下载

In [1]:

from fmz import *

task = VCtx(\'\'\'backtest

start: 2019-09-19 00:00:00

end: 2019-09-28 12:00:00

period: 15m

exchanges: [{\"eid\":\"Futures_OKCoin\",\"currency\":\"BTC_USD\", \"stocks\":1}, {\"eid\":\"OKEX\",\"currency\":\"BTC_USDT\",\"balance\":10000,\"stocks\":0}]

\'\'\')

# 创建回测环境

import matplotlib.pyplot as plt

import numpy as np

# 导入画图的库 matplotlib 和 numpy 库

In [2]:

exchanges[0].SetContractType(\"quarter\") # 第一个交易所对象OKEX期货(eid:Futures_OKCoin)调用设置当前合约的函数,设置为季度合约

initQuarterAcc = exchanges[0].GetAccount() # OKEX期货交易所初始时的账户信息,记录在变量initQuarterAcc

initQuarterAcc

Out[2]:

{\'Balance\': 0.0, \'FrozenBalance\': 0.0, \'Stocks\': 1.0, \'FrozenStocks\': 0.0}

In [3]:

initSpotAcc = exchanges[1].GetAccount() # OKEX现货交易所初始时的账户信息,记录在变量initSpotAcc

initSpotAcc

Out[3]:

{\'Balance\': 10000.0, \'FrozenBalance\': 0.0, \'Stocks\': 0.0, \'FrozenStocks\': 0.0}

In [4]:

quarterTicker1 = exchanges[0].GetTicker() # 获取期货交易所行情,记录在变量quarterTicker1

quarterTicker1

Out[4]:

{\'Time\': 1568851210000,

\'High\': 10441.25002,

\'Low\': 10441.25,

\'Sell\': 10441.25002,

\'Buy\': 10441.25,

\'Last\': 10441.25001,

\'Volume\': 1772.0,

\'OpenInterest\': 0.0}

In [5]:

spotTicker1 = exchanges[1].GetTicker() # 获取现货交易所行情,记录在变量spotTicker1

spotTicker1

Out[5]:

{\'Time\': 1568851210000,

\'High\': 10156.60000002,

\'Low\': 10156.6,

\'Sell\': 10156.60000002,

\'Buy\': 10156.6,

\'Last\': 10156.60000001,

\'Volume\': 7.4443,

\'OpenInterest\': 0.0}

In [6]:

quarterTicker1.Buy - spotTicker1.Sell # 期货做空,现货做多的差价

Out[6]:

284.64999997999985

In [7]:

exchanges[0].SetDirection(\"sell\") # 设置期货交易所,交易方向为做空

quarterId1 = exchanges[0].Sell(quarterTicker1.Buy, 10) # 期货做空下单,下单量为10张合约,返回的订单ID记录在变量quarterId1

exchanges[0].GetOrder(quarterId1) # 查询期货订单ID为quarterId1的订单详情

Out[7]:

{\'Id\': 1,

\'Price\': 10441.25,

\'Amount\': 10.0,

\'DealAmount\': 10.0,

\'AvgPrice\': 10441.25,

\'Type\': 1,

\'Offset\': 0,

\'Status\': 1,

\'ContractType\': b\'quarter\'}

In [8]:

spotAmount = 10 * 100 / quarterTicker1.Buy # 计算10张合约等值的币数,作为现货的下单量

spotId1 = exchanges[1].Buy(spotTicker1.Sell, spotAmount) # 现货交易所下单

exchanges[1].GetOrder(spotId1) # 查询现货订单ID为spotId1的订单详情

Out[8]:

{\'Id\': 1,

\'Price\': 10156.60000002,

\'Amount\': 0.0957,

\'DealAmount\': 0.0957,

\'AvgPrice\': 10156.60000002,

\'Type\': 0,

\'Offset\': 0,

\'Status\': 1,

\'ContractType\': b\'BTC_USDT_OKEX\'}

可以看到订单quarterId1、spotId1订单都完全成交,即对冲开仓完成。

In [9]:

Sleep(1000 * 60 * 60 * 24 * 7) # 持仓一段时间,等待差价变小平仓。

等待时间过后,准备平仓。获取当前的行情quarterTicker2、spotTicker2并且打印。

期货交易所对象的交易方向设置为平空仓:exchanges[0].SetDirection(\"closesell\")下单平仓。

打印平仓订单的详情,显示平仓订单完全成交,平仓完成。

In [10]:

quarterTicker2 = exchanges[0].GetTicker() # 获取当前期货交易所的行情,记录在变量quarterTicker2

quarterTicker2

Out[10]:

{\'Time\': 1569456010000,

\'High\': 8497.20002,

\'Low\': 8497.2,

\'Sell\': 8497.20002,

\'Buy\': 8497.2,

\'Last\': 8497.20001,

\'Volume\': 4311.0,

\'OpenInterest\': 0.0}

In [11]:

spotTicker2 = exchanges[1].GetTicker() # 获取当前现货交易所的行情,记录在变量spotTicker2

spotTicker2

Out[11]:

{\'Time\': 1569456114600,

\'High\': 8444.70000001,

\'Low\': 8444.69999999,

\'Sell\': 8444.70000001,

\'Buy\': 8444.69999999,

\'Last\': 8444.7,

\'Volume\': 78.6273,

\'OpenInterest\': 0.0}

In [12]:

quarterTicker2.Sell - spotTicker2.Buy # 期货空头仓位平仓,现货多头仓位平仓的差价

Out[12]:

52.5000200100003

In [13]:

exchanges[0].SetDirection(\"closesell\") # 设置期货交易所当前交易方向为平空仓

quarterId2 = exchanges[0].Buy(quarterTicker2.Sell, 10) # 期货交易所下单平仓,并且记录下单ID,记录到变量quarterId2

exchanges[0].GetOrder(quarterId2) # 查询期货平仓订单详情

Out[13]:

{\'Id\': 2,

\'Price\': 8497.20002,

\'Amount\': 10.0,

\'DealAmount\': 10.0,

\'AvgPrice\': 8493.95335,

\'Type\': 0,

\'Offset\': 1,

\'Status\': 1,

\'ContractType\': b\'quarter\'}

In [14]:

spotId2 = exchanges[1].Sell(spotTicker2.Buy, spotAmount) # 现货交易所下单平仓,并且记录下单ID,记录到变量spotId2

exchanges[1].GetOrder(spotId2) # 查询现货平仓订单详情

Out[14]:

{\'Id\': 2,

\'Price\': 8444.69999999,

\'Amount\': 0.0957,

\'DealAmount\': 0.0957,

\'AvgPrice\': 8444.69999999,

\'Type\': 1,

\'Offset\': 0,

\'Status\': 1,

\'ContractType\': b\'BTC_USDT_OKEX\'}

In [15]:

nowQuarterAcc = exchanges[0].GetAccount() # 获取当前期货交易所账户信息,记录在变量nowQuarterAcc

nowQuarterAcc

Out[15]:

{\'Balance\': 0.0,

\'FrozenBalance\': 0.0,

\'Stocks\': 1.021786026184,

\'FrozenStocks\': 0.0}

In [16]:

nowSpotAcc = exchanges[1].GetAccount() # 获取当前现货交易所账户信息,记录在变量nowSpotAcc

nowSpotAcc

Out[16]:

{\'Balance\': 9834.74705446,

\'FrozenBalance\': 0.0,

\'Stocks\': 0.0,

\'FrozenStocks\': 0.0}

通过对比最初账户和当前账户,计算出此次对冲操作的收益盈亏。

In [17]:

diffStocks = abs(nowQuarterAcc.Stocks - initQuarterAcc.Stocks)

diffBalance = nowSpotAcc.Balance - initSpotAcc.Balance

if nowQuarterAcc.Stocks - initQuarterAcc.Stocks > 0 :

print(\"收益:\", diffStocks * spotTicker2.Buy + diffBalance)

else :

print(\"收益:\", diffBalance - diffStocks * spotTicker2.Buy)

Out[17]:

收益: 18.72350977580652

下面我们看下为什么此次对冲是盈利的。我们可以看到画出的图表,期货价格是蓝色的线,现货价格是橙色的线,两个价格都是下降的,期货价格下降的比现货价格快。

In [18]:

xQuarter = [1, 2]

yQuarter = [quarterTicker1.Buy, quarterTicker2.Sell]

xSpot = [1, 2]

ySpot = [spotTicker1.Sell, spotTicker2.Buy]

plt.plot(xQuarter, yQuarter, linewidth=5)

plt.plot(xSpot, ySpot, linewidth=5)

plt.show()

Out[18]:

我们再看下差价的变化情况,差价是从对冲开仓时的284(即期货做空,现货最多),到平仓时的52(期货空头持仓平仓,现货多仓平仓)。差价是从大到小。

In [19]:

xDiff = [1, 2]

yDiff = [quarterTicker1.Buy - spotTicker1.Sell, quarterTicker2.Sell - spotTicker2.Buy]

plt.plot(xDiff, yDiff, linewidth=5)

plt.show()

Out[19]:

我们举个例子,a1为时刻1的期货价格,b1为时刻1的现货价格。a2为时刻2的期货价格,b2为时刻2的现货价格。

只要a1-b1即时刻1的期货现货差价大于a2-b2即时刻2时的期货现货差价,就可以推出a1 – a2 > b1 – b2。

有三种情况:(期货现货持仓头寸规模相同)

- 1、a1 – a2大于0,b1 – b2大于0

a1 – a2为期货盈利的差价,b1 – b2为现货亏损的差价(因为现货做多,开始买入的价格比卖出平仓的价格高,所以亏钱),但是期货盈利的大于现货亏损的。所以整体是盈利。这种情况对应的就是步骤In[8]中的图表情况。

- 2、a1 – a2大于0,b1 – b2小于0

a1 – a2为期货盈利的差价,b1 – b2为现货盈利的差价(b1 – b2 小于0,说明b2大于b1,即开仓买入的价格低,卖出平仓的价格高,所以盈利)

- 3、a1 – a2小于0,b1 – b2小于0

a1 – a2为期货亏损的差价,b1 – b2为现货盈利的差价由于a1 – a2 > b1 – b2,a1 – a2的绝对值小于b1 – b2的绝对值,现货的盈利大于期货的亏损。整体为盈利。

不存在 a1 – a2小于0,b1 – b2大于0这种情况,因为已经限定了a1 – a2 > b1 – b2。同样如果a1 – a2等于0,由于a1 – a2 > b1 – b2限定,b1 – b2就一定是小于0的。所以只要是期货做空,现货做多的对冲方式,符合条件a1 – b1 > a2 – b2,的开仓平仓操作,即为盈利对冲。

例如以下模型为其中一种情况:

In [20]:

a1 = 10

b1 = 5

a2 = 11

b2 = 9

# a1 - b1 > a2 - b2 推出 : a1 - a2 > b1 - b2

xA = [1, 2]

yA = [a1, a2]

xB = [1, 2]

yB = [b1, b2]

plt.plot(xA, yA, linewidth=5)

plt.plot(xB, yB, linewidth=5)

plt.show()

Out[20]:

-

研究环境JavaScript语言文件

研究环境不止支持Python,还支持JavaScript

下面我也给出一个JavaScript的研究环境范例:

期现对冲原理分析(JavaScript).ipynb下载

In [1]:

// 导入需要的程序包, 在发明者 \"策略编辑页面\" 点击 \"保存回测设置\" 即可获取字符串配置, 转换为对象即可

var fmz = require(\"fmz\") // 引入后自动导入 talib, TA, plot 库

var task = fmz.VCtx({

start: \'2019-09-19 00:00:00\',

end: \'2019-09-28 12:00:00\',

period: \'15m\',

exchanges: [{\"eid\":\"Futures_OKCoin\",\"currency\":\"BTC_USD\",\"stocks\":1},{\"eid\":\"OKEX\",\"currency\":\"BTC_USDT\",\"balance\":10000,\"stocks\":0}]

})

In [2]:

exchanges[0].SetContractType(\"quarter\") // 第一个交易所对象OKEX期货(eid:Futures_OKCoin)调用设置当前合约的函数,设置为季度合约

var initQuarterAcc = exchanges[0].GetAccount() // OKEX期货交易所初始时的账户信息,记录在变量initQuarterAcc

initQuarterAcc

Out[2]:

{ Balance: 0, FrozenBalance: 0, Stocks: 1, FrozenStocks: 0 }

In [3]:

var initSpotAcc = exchanges[1].GetAccount() // OKEX现货交易所初始时的账户信息,记录在变量initSpotAcc

initSpotAcc

Out[3]:

{ Balance: 10000, FrozenBalance: 0, Stocks: 0, FrozenStocks: 0 }

In [4]:

var quarterTicker1 = exchanges[0].GetTicker() // 获取期货交易所行情,记录在变量quarterTicker1

quarterTicker1

Out[4]:

{ Time: 1568851210000,

High: 10441.25002,

Low: 10441.25,

Sell: 10441.25002,

Buy: 10441.25,

Last: 10441.25001,

Volume: 1772,

OpenInterest: 0 }

In [5]:

var spotTicker1 = exchanges[1].GetTicker() // 获取现货交易所行情,记录在变量spotTicker1

spotTicker1

Out[5]:

{ Time: 1568851210000,

High: 10156.60000002,

Low: 10156.6,

Sell: 10156.60000002,

Buy: 10156.6,

Last: 10156.60000001,

Volume: 7.4443,

OpenInterest: 0 }

In [6]:

quarterTicker1.Buy - spotTicker1.Sell // 期货做空,现货做多的差价

Out[6]:

284.64999997999985

In [7]:

exchanges[0].SetDirection(\"sell\") // 设置期货交易所,交易方向为做空

var quarterId1 = exchanges[0].Sell(quarterTicker1.Buy, 10) // 期货做空下单,下单量为10张合约,返回的订单ID记录在变量quarterId1

exchanges[0].GetOrder(quarterId1) // 查询期货订单ID为quarterId1的订单详情

Out[7]:

{ Id: 1,

Price: 10441.25,

Amount: 10,

DealAmount: 10,

AvgPrice: 10441.25,

Type: 1,

Offset: 0,

Status: 1,

ContractType: \'quarter\' }

In [8]:

var spotAmount = 10 * 100 / quarterTicker1.Buy // 计算10张合约等值的币数,作为现货的下单量

var spotId1 = exchanges[1].Buy(spotTicker1.Sell, spotAmount) // 现货交易所下单

exchanges[1].GetOrder(spotId1) // 查询现货订单ID为spotId1的订单详情

Out[8]:

{ Id: 1,

Price: 10156.60000002,

Amount: 0.0957,

DealAmount: 0.0957,

AvgPrice: 10156.60000002,

Type: 0,

Offset: 0,

Status: 1,

ContractType: \'BTC_USDT_OKEX\' }

可以看到订单quarterId1、spotId1订单都完全成交,即对冲开仓完成。

In [9]:

Sleep(1000 * 60 * 60 * 24 * 7) // 持仓一段时间,等待差价变小平仓。

等待时间过后,准备平仓。获取当前的行情quarterTicker2、spotTicker2并且打印。

期货交易所对象的交易方向设置为平空仓:exchanges[0].SetDirection(\"closesell\")下单平仓。

打印平仓订单的详情,显示平仓订单完全成交,平仓完成。

In [10]:

var quarterTicker2 = exchanges[0].GetTicker() // 获取当前期货交易所的行情,记录在变量quarterTicker2

quarterTicker2

Out[10]:

{ Time: 1569456010000,

High: 8497.20002,

Low: 8497.2,

Sell: 8497.20002,

Buy: 8497.2,

Last: 8497.20001,

Volume: 4311,

OpenInterest: 0 }

In [11]:

var spotTicker2 = exchanges[1].GetTicker() // 获取当前现货交易所的行情,记录在变量spotTicker2

spotTicker2

Out[11]:

{ Time: 1569456114600,

High: 8444.70000001,

Low: 8444.69999999,

Sell: 8444.70000001,

Buy: 8444.69999999,

Last: 8444.7,

Volume: 78.6273,

OpenInterest: 0 }

In [12]:

quarterTicker2.Sell - spotTicker2.Buy // 期货空头仓位平仓,现货多头仓位平仓的差价

Out[12]:

52.5000200100003

In [13]:

exchanges[0].SetDirection(\"closesell\") // 设置期货交易所当前交易方向为平空仓

var quarterId2 = exchanges[0].Buy(quarterTicker2.Sell, 10) // 期货交易所下单平仓,并且记录下单ID,记录到变量quarterId2

exchanges[0].GetOrder(quarterId2) // 查询期货平仓订单详情

Out[13]:

{ Id: 2,

Price: 8497.20002,

Amount: 10,

DealAmount: 10,

AvgPrice: 8493.95335,

Type: 0,

Offset: 1,

Status: 1,

ContractType: \'quarter\' }

In [14]:

var spotId2 = exchanges[1].Sell(spotTicker2.Buy, spotAmount) // 现货交易所下单平仓,并且记录下单ID,记录到变量spotId2

exchanges[1].GetOrder(spotId2) // 查询现货平仓订单详情

Out[14]:

{ Id: 2,

Price: 8444.69999999,

Amount: 0.0957,

DealAmount: 0.0957,

AvgPrice: 8444.69999999,

Type: 1,

Offset: 0,

Status: 1,

ContractType: \'BTC_USDT_OKEX\' }

In [15]:

var nowQuarterAcc = exchanges[0].GetAccount() // 获取当前期货交易所账户信息,记录在变量nowQuarterAcc

nowQuarterAcc

Out[15]:

{ Balance: 0,

FrozenBalance: 0,

Stocks: 1.021786026184,

FrozenStocks: 0 }

In [16]:

var nowSpotAcc = exchanges[1].GetAccount() // 获取当前现货交易所账户信息,记录在变量nowSpotAcc

nowSpotAcc

Out[16]:

{ Balance: 9834.74705446,

FrozenBalance: 0,

Stocks: 0,

FrozenStocks: 0 }

通过对比最初账户和当前账户,计算出此次对冲操作的收益盈亏。

In [17]:

var diffStocks = Math.abs(nowQuarterAcc.Stocks - initQuarterAcc.Stocks)

var diffBalance = nowSpotAcc.Balance - initSpotAcc.Balance

if (nowQuarterAcc.Stocks - initQuarterAcc.Stocks > 0) {

console.log(\"收益:\", diffStocks * spotTicker2.Buy + diffBalance)

} else {

console.log(\"收益:\", diffBalance - diffStocks * spotTicker2.Buy)

}

Out[17]:

收益: 18.72350977580652

下面我们看下为什么此次对冲是盈利的。我们可以看到画出的图表,期货价格是蓝色的线,现货价格是橙色的线,两个价格都是下降的,期货价格下降的比现货价格快。

In [18]:

var objQuarter = {

\"index\" : [1, 2], // 索引index 为1 即第一个时刻,开仓时刻,2为平仓时刻。

\"arrPrice\" : [quarterTicker1.Buy, quarterTicker2.Sell],

}

var objSpot = {

\"index\" : [1, 2],

\"arrPrice\" : [spotTicker1.Sell, spotTicker2.Buy],

}

plot([{name: \'quarter\', x: objQuarter.index, y: objQuarter.arrPrice}, {name: \'spot\', x: objSpot.index, y: objSpot.arrPrice}])

Out[18]:

我们再看下差价的变化情况,差价是从对冲开仓时的284(即期货做空,现货最多),到平仓时的52(期货空头持仓平仓,现货多仓平仓)。差价是从大到小。

In [19]:

var arrDiffPrice = [quarterTicker1.Buy - spotTicker1.Sell, quarterTicker2.Sell - spotTicker2.Buy]

plot(arrDiffPrice)

Out[19]:

我们举个例子,a1为时刻1的期货价格,b1为时刻1的现货价格。a2为时刻2的期货价格,b2为时刻2的现货价格。

只要a1-b1即时刻1的期货现货差价大于a2-b2即时刻2时的期货现货差价,就可以推出a1 – a2 > b1 – b2。

有三种情况:(期货现货持仓头寸规模相同)

- 1、a1 – a2大于0,b1 – b2大于0

a1 – a2为期货盈利的差价,b1 – b2为现货亏损的差价(因为现货做多,开始买入的价格比卖出平仓的价格高,所以亏钱),但是期货盈利的大于现货亏损的。所以整体是盈利。这种情况对应的就是步骤In[8]中的图表情况。

- 2、a1 – a2大于0,b1 – b2小于0

a1 – a2为期货盈利的差价,b1 – b2为现货盈利的差价(b1 – b2 小于0,说明b2大于b1,即开仓买入的价格低,卖出平仓的价格高,所以盈利)

- 3、a1 – a2小于0,b1 – b2小于0

a1 – a2为期货亏损的差价,b1 – b2为现货盈利的差价由于a1 – a2 > b1 – b2,a1 – a2的绝对值小于b1 – b2的绝对值,现货的盈利大于期货的亏损。整体为盈利。

不存在 a1 – a2小于0,b1 – b2大于0这种情况,因为已经限定了a1 – a2 > b1 – b2。同样如果a1 – a2等于0,由于a1 – a2 > b1 – b2限定,b1 – b2就一定是小于0的。所以只要是期货做空,现货做多的对冲方式,符合条件a1 – b1 > a2 – b2,的开仓平仓操作,即为盈利对冲。

例如以下模型为其中一种情况:

In [20]:

var a1 = 10

var b1 = 5

var a2 = 11

var b2 = 9

// a1 - b1 > a2 - b2 推出 : a1 - a2 > b1 - b2

var objA = {

\"index\" : [1, 2],

\"arrPrice\" : [a1, a2],

}

var objB = {

\"index\" : [1, 2],

\"arrPrice\" : [b1, b2],

}

plot([{name : \"a\", x : objA.index, y : objA.arrPrice}, {name : \"b\", x : objB.index, y : objB.arrPrice}])

Out[20]:

小伙伴们赶紧动手试一下吧!

FMZ量化交易平台邀请链接:https://www.fmz.com/

全球最大交易所币安,国区邀请链接:https://accounts.binance.com/zh-CN/register?ref=16003031 币安注册不了IP地址用香港,居住地选香港,认证照旧,邮箱推荐如gmail、outlook。支持币种多,交易安全!

买好币上KuCoin:https://www.kucoin.com/r/af/1f7w3 CoinMarketCap前五的交易所,注册友好操简单快捷!

目前不清退的交易所推荐:

1、全球第二大交易所OKX欧意,邀请链接:https://www.myts3cards.com/cn/join/1837888 注册简单,交易不需要实名,新用户能开合约,币种多,交易量大!。

2、老牌交易所比特儿现改名叫芝麻开门 :https://www.gate.win/signup/649183

买好币上币库:https://www.kucoin.com/r/1f7w3

火必所有用户现在可用了,但是要重新注册账号火币:https://www.huobi.com

全球最大交易所币安,

国区邀请链接:https://accounts.suitechsui.mobi/zh-CN/register?ref=16003031 支持86手机号码,网页直接注册。

这个分析文件是对于回测时的一次期现对冲开仓平仓做的过程分析,期货交易所为OKEX期货,合约为季度合约

quarter。现货交易所为OKEX币币交易,交易对为BTC_USDT,分析期现对冲操作流程的,可以看下面具体研究环境文件,写了两个版本,一个Python语言描述,一个JavaScript语言描述。研究环境Python语言文件

期现对冲原理分析.ipynb下载

In [1]:

from fmz import *

task = VCtx(\'\'\'backtest

start: 2019-09-19 00:00:00

end: 2019-09-28 12:00:00

period: 15m

exchanges: [{\"eid\":\"Futures_OKCoin\",\"currency\":\"BTC_USD\", \"stocks\":1}, {\"eid\":\"OKEX\",\"currency\":\"BTC_USDT\",\"balance\":10000,\"stocks\":0}]

\'\'\')

# 创建回测环境

import matplotlib.pyplot as plt

import numpy as np

# 导入画图的库 matplotlib 和 numpy 库In [2]:

exchanges[0].SetContractType(\"quarter\") # 第一个交易所对象OKEX期货(eid:Futures_OKCoin)调用设置当前合约的函数,设置为季度合约

initQuarterAcc = exchanges[0].GetAccount() # OKEX期货交易所初始时的账户信息,记录在变量initQuarterAcc

initQuarterAccOut[2]:

{\'Balance\': 0.0, \'FrozenBalance\': 0.0, \'Stocks\': 1.0, \'FrozenStocks\': 0.0}

In [3]:

initSpotAcc = exchanges[1].GetAccount() # OKEX现货交易所初始时的账户信息,记录在变量initSpotAcc

initSpotAccOut[3]:

{\'Balance\': 10000.0, \'FrozenBalance\': 0.0, \'Stocks\': 0.0, \'FrozenStocks\': 0.0}

In [4]:

quarterTicker1 = exchanges[0].GetTicker() # 获取期货交易所行情,记录在变量quarterTicker1

quarterTicker1Out[4]:

{\'Time\': 1568851210000,

\'High\': 10441.25002,

\'Low\': 10441.25,

\'Sell\': 10441.25002,

\'Buy\': 10441.25,

\'Last\': 10441.25001,

\'Volume\': 1772.0,

\'OpenInterest\': 0.0}

In [5]:

spotTicker1 = exchanges[1].GetTicker() # 获取现货交易所行情,记录在变量spotTicker1

spotTicker1Out[5]:

{\'Time\': 1568851210000,

\'High\': 10156.60000002,

\'Low\': 10156.6,

\'Sell\': 10156.60000002,

\'Buy\': 10156.6,

\'Last\': 10156.60000001,

\'Volume\': 7.4443,

\'OpenInterest\': 0.0}

In [6]:

quarterTicker1.Buy - spotTicker1.Sell # 期货做空,现货做多的差价Out[6]:

284.64999997999985

In [7]:

exchanges[0].SetDirection(\"sell\") # 设置期货交易所,交易方向为做空

quarterId1 = exchanges[0].Sell(quarterTicker1.Buy, 10) # 期货做空下单,下单量为10张合约,返回的订单ID记录在变量quarterId1

exchanges[0].GetOrder(quarterId1) # 查询期货订单ID为quarterId1的订单详情Out[7]:

{\'Id\': 1,

\'Price\': 10441.25,

\'Amount\': 10.0,

\'DealAmount\': 10.0,

\'AvgPrice\': 10441.25,

\'Type\': 1,

\'Offset\': 0,

\'Status\': 1,

\'ContractType\': b\'quarter\'}

In [8]:

spotAmount = 10 * 100 / quarterTicker1.Buy # 计算10张合约等值的币数,作为现货的下单量

spotId1 = exchanges[1].Buy(spotTicker1.Sell, spotAmount) # 现货交易所下单

exchanges[1].GetOrder(spotId1) # 查询现货订单ID为spotId1的订单详情Out[8]:

{\'Id\': 1,

\'Price\': 10156.60000002,

\'Amount\': 0.0957,

\'DealAmount\': 0.0957,

\'AvgPrice\': 10156.60000002,

\'Type\': 0,

\'Offset\': 0,

\'Status\': 1,

\'ContractType\': b\'BTC_USDT_OKEX\'}

可以看到订单quarterId1、spotId1订单都完全成交,即对冲开仓完成。

In [9]:

Sleep(1000 * 60 * 60 * 24 * 7) # 持仓一段时间,等待差价变小平仓。等待时间过后,准备平仓。获取当前的行情quarterTicker2、spotTicker2并且打印。

期货交易所对象的交易方向设置为平空仓:exchanges[0].SetDirection(\"closesell\")下单平仓。

打印平仓订单的详情,显示平仓订单完全成交,平仓完成。

In [10]:

quarterTicker2 = exchanges[0].GetTicker() # 获取当前期货交易所的行情,记录在变量quarterTicker2

quarterTicker2Out[10]:

{\'Time\': 1569456010000,

\'High\': 8497.20002,

\'Low\': 8497.2,

\'Sell\': 8497.20002,

\'Buy\': 8497.2,

\'Last\': 8497.20001,

\'Volume\': 4311.0,

\'OpenInterest\': 0.0}

In [11]:

spotTicker2 = exchanges[1].GetTicker() # 获取当前现货交易所的行情,记录在变量spotTicker2

spotTicker2Out[11]:

{\'Time\': 1569456114600,

\'High\': 8444.70000001,

\'Low\': 8444.69999999,

\'Sell\': 8444.70000001,

\'Buy\': 8444.69999999,

\'Last\': 8444.7,

\'Volume\': 78.6273,

\'OpenInterest\': 0.0}

In [12]:

quarterTicker2.Sell - spotTicker2.Buy # 期货空头仓位平仓,现货多头仓位平仓的差价Out[12]:

52.5000200100003

In [13]:

exchanges[0].SetDirection(\"closesell\") # 设置期货交易所当前交易方向为平空仓

quarterId2 = exchanges[0].Buy(quarterTicker2.Sell, 10) # 期货交易所下单平仓,并且记录下单ID,记录到变量quarterId2

exchanges[0].GetOrder(quarterId2) # 查询期货平仓订单详情Out[13]:

{\'Id\': 2,

\'Price\': 8497.20002,

\'Amount\': 10.0,

\'DealAmount\': 10.0,

\'AvgPrice\': 8493.95335,

\'Type\': 0,

\'Offset\': 1,

\'Status\': 1,

\'ContractType\': b\'quarter\'}

In [14]:

spotId2 = exchanges[1].Sell(spotTicker2.Buy, spotAmount) # 现货交易所下单平仓,并且记录下单ID,记录到变量spotId2

exchanges[1].GetOrder(spotId2) # 查询现货平仓订单详情Out[14]:

{\'Id\': 2,

\'Price\': 8444.69999999,

\'Amount\': 0.0957,

\'DealAmount\': 0.0957,

\'AvgPrice\': 8444.69999999,

\'Type\': 1,

\'Offset\': 0,

\'Status\': 1,

\'ContractType\': b\'BTC_USDT_OKEX\'}

In [15]:

nowQuarterAcc = exchanges[0].GetAccount() # 获取当前期货交易所账户信息,记录在变量nowQuarterAcc

nowQuarterAccOut[15]:

{\'Balance\': 0.0,

\'FrozenBalance\': 0.0,

\'Stocks\': 1.021786026184,

\'FrozenStocks\': 0.0}

In [16]:

nowSpotAcc = exchanges[1].GetAccount() # 获取当前现货交易所账户信息,记录在变量nowSpotAcc

nowSpotAccOut[16]:

{\'Balance\': 9834.74705446,

\'FrozenBalance\': 0.0,

\'Stocks\': 0.0,

\'FrozenStocks\': 0.0}

通过对比最初账户和当前账户,计算出此次对冲操作的收益盈亏。

In [17]:

diffStocks = abs(nowQuarterAcc.Stocks - initQuarterAcc.Stocks)

diffBalance = nowSpotAcc.Balance - initSpotAcc.Balance

if nowQuarterAcc.Stocks - initQuarterAcc.Stocks > 0 :

print(\"收益:\", diffStocks * spotTicker2.Buy + diffBalance)

else :

print(\"收益:\", diffBalance - diffStocks * spotTicker2.Buy)Out[17]:

收益: 18.72350977580652

下面我们看下为什么此次对冲是盈利的。我们可以看到画出的图表,期货价格是蓝色的线,现货价格是橙色的线,两个价格都是下降的,期货价格下降的比现货价格快。

In [18]:

xQuarter = [1, 2]

yQuarter = [quarterTicker1.Buy, quarterTicker2.Sell]

xSpot = [1, 2]

ySpot = [spotTicker1.Sell, spotTicker2.Buy]

plt.plot(xQuarter, yQuarter, linewidth=5)

plt.plot(xSpot, ySpot, linewidth=5)

plt.show()Out[18]:

![]()

我们再看下差价的变化情况,差价是从对冲开仓时的284(即期货做空,现货最多),到平仓时的52(期货空头持仓平仓,现货多仓平仓)。差价是从大到小。

In [19]:

xDiff = [1, 2]

yDiff = [quarterTicker1.Buy - spotTicker1.Sell, quarterTicker2.Sell - spotTicker2.Buy]

plt.plot(xDiff, yDiff, linewidth=5)

plt.show()Out[19]:

![]()

我们举个例子,a1为时刻1的期货价格,b1为时刻1的现货价格。a2为时刻2的期货价格,b2为时刻2的现货价格。

只要a1-b1即时刻1的期货现货差价大于a2-b2即时刻2时的期货现货差价,就可以推出a1 – a2 > b1 – b2。

有三种情况:(期货现货持仓头寸规模相同)

- 1、a1 – a2大于0,b1 – b2大于0

a1 – a2为期货盈利的差价,b1 – b2为现货亏损的差价(因为现货做多,开始买入的价格比卖出平仓的价格高,所以亏钱),但是期货盈利的大于现货亏损的。所以整体是盈利。这种情况对应的就是步骤In[8]中的图表情况。 - 2、a1 – a2大于0,b1 – b2小于0

a1 – a2为期货盈利的差价,b1 – b2为现货盈利的差价(b1 – b2 小于0,说明b2大于b1,即开仓买入的价格低,卖出平仓的价格高,所以盈利) - 3、a1 – a2小于0,b1 – b2小于0

a1 – a2为期货亏损的差价,b1 – b2为现货盈利的差价由于a1 – a2 > b1 – b2,a1 – a2的绝对值小于b1 – b2的绝对值,现货的盈利大于期货的亏损。整体为盈利。

不存在 a1 – a2小于0,b1 – b2大于0这种情况,因为已经限定了a1 – a2 > b1 – b2。同样如果a1 – a2等于0,由于a1 – a2 > b1 – b2限定,b1 – b2就一定是小于0的。所以只要是期货做空,现货做多的对冲方式,符合条件a1 – b1 > a2 – b2,的开仓平仓操作,即为盈利对冲。

例如以下模型为其中一种情况:

In [20]:

a1 = 10

b1 = 5

a2 = 11

b2 = 9

# a1 - b1 > a2 - b2 推出 : a1 - a2 > b1 - b2

xA = [1, 2]

yA = [a1, a2]

xB = [1, 2]

yB = [b1, b2]

plt.plot(xA, yA, linewidth=5)

plt.plot(xB, yB, linewidth=5)

plt.show()Out[20]:

![]()

研究环境JavaScript语言文件

研究环境不止支持Python,还支持JavaScript

下面我也给出一个JavaScript的研究环境范例:

期现对冲原理分析(JavaScript).ipynb下载

In [1]:

// 导入需要的程序包, 在发明者 \"策略编辑页面\" 点击 \"保存回测设置\" 即可获取字符串配置, 转换为对象即可

var fmz = require(\"fmz\") // 引入后自动导入 talib, TA, plot 库

var task = fmz.VCtx({

start: \'2019-09-19 00:00:00\',

end: \'2019-09-28 12:00:00\',

period: \'15m\',

exchanges: [{\"eid\":\"Futures_OKCoin\",\"currency\":\"BTC_USD\",\"stocks\":1},{\"eid\":\"OKEX\",\"currency\":\"BTC_USDT\",\"balance\":10000,\"stocks\":0}]

})In [2]:

exchanges[0].SetContractType(\"quarter\") // 第一个交易所对象OKEX期货(eid:Futures_OKCoin)调用设置当前合约的函数,设置为季度合约

var initQuarterAcc = exchanges[0].GetAccount() // OKEX期货交易所初始时的账户信息,记录在变量initQuarterAcc

initQuarterAccOut[2]:

{ Balance: 0, FrozenBalance: 0, Stocks: 1, FrozenStocks: 0 }

In [3]:

var initSpotAcc = exchanges[1].GetAccount() // OKEX现货交易所初始时的账户信息,记录在变量initSpotAcc

initSpotAccOut[3]:

{ Balance: 10000, FrozenBalance: 0, Stocks: 0, FrozenStocks: 0 }

In [4]:

var quarterTicker1 = exchanges[0].GetTicker() // 获取期货交易所行情,记录在变量quarterTicker1

quarterTicker1Out[4]:

{ Time: 1568851210000,

High: 10441.25002,

Low: 10441.25,

Sell: 10441.25002,

Buy: 10441.25,

Last: 10441.25001,

Volume: 1772,

OpenInterest: 0 }

In [5]:

var spotTicker1 = exchanges[1].GetTicker() // 获取现货交易所行情,记录在变量spotTicker1

spotTicker1Out[5]:

{ Time: 1568851210000,

High: 10156.60000002,

Low: 10156.6,

Sell: 10156.60000002,

Buy: 10156.6,

Last: 10156.60000001,

Volume: 7.4443,

OpenInterest: 0 }

In [6]:

quarterTicker1.Buy - spotTicker1.Sell // 期货做空,现货做多的差价Out[6]:

284.64999997999985

In [7]:

exchanges[0].SetDirection(\"sell\") // 设置期货交易所,交易方向为做空

var quarterId1 = exchanges[0].Sell(quarterTicker1.Buy, 10) // 期货做空下单,下单量为10张合约,返回的订单ID记录在变量quarterId1

exchanges[0].GetOrder(quarterId1) // 查询期货订单ID为quarterId1的订单详情Out[7]:

{ Id: 1,

Price: 10441.25,

Amount: 10,

DealAmount: 10,

AvgPrice: 10441.25,

Type: 1,

Offset: 0,

Status: 1,

ContractType: \'quarter\' }

In [8]:

var spotAmount = 10 * 100 / quarterTicker1.Buy // 计算10张合约等值的币数,作为现货的下单量

var spotId1 = exchanges[1].Buy(spotTicker1.Sell, spotAmount) // 现货交易所下单

exchanges[1].GetOrder(spotId1) // 查询现货订单ID为spotId1的订单详情Out[8]:

{ Id: 1,

Price: 10156.60000002,

Amount: 0.0957,

DealAmount: 0.0957,

AvgPrice: 10156.60000002,

Type: 0,

Offset: 0,

Status: 1,

ContractType: \'BTC_USDT_OKEX\' }

可以看到订单quarterId1、spotId1订单都完全成交,即对冲开仓完成。

In [9]:

Sleep(1000 * 60 * 60 * 24 * 7) // 持仓一段时间,等待差价变小平仓。等待时间过后,准备平仓。获取当前的行情quarterTicker2、spotTicker2并且打印。

期货交易所对象的交易方向设置为平空仓:exchanges[0].SetDirection(\"closesell\")下单平仓。

打印平仓订单的详情,显示平仓订单完全成交,平仓完成。

In [10]:

var quarterTicker2 = exchanges[0].GetTicker() // 获取当前期货交易所的行情,记录在变量quarterTicker2

quarterTicker2Out[10]:

{ Time: 1569456010000,

High: 8497.20002,

Low: 8497.2,

Sell: 8497.20002,

Buy: 8497.2,

Last: 8497.20001,

Volume: 4311,

OpenInterest: 0 }

In [11]:

var spotTicker2 = exchanges[1].GetTicker() // 获取当前现货交易所的行情,记录在变量spotTicker2

spotTicker2Out[11]:

{ Time: 1569456114600,

High: 8444.70000001,

Low: 8444.69999999,

Sell: 8444.70000001,

Buy: 8444.69999999,

Last: 8444.7,

Volume: 78.6273,

OpenInterest: 0 }

In [12]:

quarterTicker2.Sell - spotTicker2.Buy // 期货空头仓位平仓,现货多头仓位平仓的差价Out[12]:

52.5000200100003

In [13]:

exchanges[0].SetDirection(\"closesell\") // 设置期货交易所当前交易方向为平空仓

var quarterId2 = exchanges[0].Buy(quarterTicker2.Sell, 10) // 期货交易所下单平仓,并且记录下单ID,记录到变量quarterId2

exchanges[0].GetOrder(quarterId2) // 查询期货平仓订单详情Out[13]:

{ Id: 2,

Price: 8497.20002,

Amount: 10,

DealAmount: 10,

AvgPrice: 8493.95335,

Type: 0,

Offset: 1,

Status: 1,

ContractType: \'quarter\' }

In [14]:

var spotId2 = exchanges[1].Sell(spotTicker2.Buy, spotAmount) // 现货交易所下单平仓,并且记录下单ID,记录到变量spotId2

exchanges[1].GetOrder(spotId2) // 查询现货平仓订单详情Out[14]:

{ Id: 2,

Price: 8444.69999999,

Amount: 0.0957,

DealAmount: 0.0957,

AvgPrice: 8444.69999999,

Type: 1,

Offset: 0,

Status: 1,

ContractType: \'BTC_USDT_OKEX\' }

In [15]:

var nowQuarterAcc = exchanges[0].GetAccount() // 获取当前期货交易所账户信息,记录在变量nowQuarterAcc

nowQuarterAcc Out[15]:

{ Balance: 0,

FrozenBalance: 0,

Stocks: 1.021786026184,

FrozenStocks: 0 }

In [16]:

var nowSpotAcc = exchanges[1].GetAccount() // 获取当前现货交易所账户信息,记录在变量nowSpotAcc

nowSpotAccOut[16]:

{ Balance: 9834.74705446,

FrozenBalance: 0,

Stocks: 0,

FrozenStocks: 0 }

通过对比最初账户和当前账户,计算出此次对冲操作的收益盈亏。

In [17]:

var diffStocks = Math.abs(nowQuarterAcc.Stocks - initQuarterAcc.Stocks)

var diffBalance = nowSpotAcc.Balance - initSpotAcc.Balance

if (nowQuarterAcc.Stocks - initQuarterAcc.Stocks > 0) {

console.log(\"收益:\", diffStocks * spotTicker2.Buy + diffBalance)

} else {

console.log(\"收益:\", diffBalance - diffStocks * spotTicker2.Buy)

}Out[17]:

收益: 18.72350977580652

下面我们看下为什么此次对冲是盈利的。我们可以看到画出的图表,期货价格是蓝色的线,现货价格是橙色的线,两个价格都是下降的,期货价格下降的比现货价格快。

In [18]:

var objQuarter = {

\"index\" : [1, 2], // 索引index 为1 即第一个时刻,开仓时刻,2为平仓时刻。

\"arrPrice\" : [quarterTicker1.Buy, quarterTicker2.Sell],

}

var objSpot = {

\"index\" : [1, 2],

\"arrPrice\" : [spotTicker1.Sell, spotTicker2.Buy],

}

plot([{name: \'quarter\', x: objQuarter.index, y: objQuarter.arrPrice}, {name: \'spot\', x: objSpot.index, y: objSpot.arrPrice}])Out[18]:

我们再看下差价的变化情况,差价是从对冲开仓时的284(即期货做空,现货最多),到平仓时的52(期货空头持仓平仓,现货多仓平仓)。差价是从大到小。

In [19]:

var arrDiffPrice = [quarterTicker1.Buy - spotTicker1.Sell, quarterTicker2.Sell - spotTicker2.Buy]

plot(arrDiffPrice)Out[19]:

我们举个例子,a1为时刻1的期货价格,b1为时刻1的现货价格。a2为时刻2的期货价格,b2为时刻2的现货价格。

只要a1-b1即时刻1的期货现货差价大于a2-b2即时刻2时的期货现货差价,就可以推出a1 – a2 > b1 – b2。

有三种情况:(期货现货持仓头寸规模相同)

- 1、a1 – a2大于0,b1 – b2大于0

a1 – a2为期货盈利的差价,b1 – b2为现货亏损的差价(因为现货做多,开始买入的价格比卖出平仓的价格高,所以亏钱),但是期货盈利的大于现货亏损的。所以整体是盈利。这种情况对应的就是步骤In[8]中的图表情况。 - 2、a1 – a2大于0,b1 – b2小于0

a1 – a2为期货盈利的差价,b1 – b2为现货盈利的差价(b1 – b2 小于0,说明b2大于b1,即开仓买入的价格低,卖出平仓的价格高,所以盈利) - 3、a1 – a2小于0,b1 – b2小于0

a1 – a2为期货亏损的差价,b1 – b2为现货盈利的差价由于a1 – a2 > b1 – b2,a1 – a2的绝对值小于b1 – b2的绝对值,现货的盈利大于期货的亏损。整体为盈利。

不存在 a1 – a2小于0,b1 – b2大于0这种情况,因为已经限定了a1 – a2 > b1 – b2。同样如果a1 – a2等于0,由于a1 – a2 > b1 – b2限定,b1 – b2就一定是小于0的。所以只要是期货做空,现货做多的对冲方式,符合条件a1 – b1 > a2 – b2,的开仓平仓操作,即为盈利对冲。

例如以下模型为其中一种情况:

In [20]:

var a1 = 10

var b1 = 5

var a2 = 11

var b2 = 9

// a1 - b1 > a2 - b2 推出 : a1 - a2 > b1 - b2

var objA = {

\"index\" : [1, 2],

\"arrPrice\" : [a1, a2],

}

var objB = {

\"index\" : [1, 2],

\"arrPrice\" : [b1, b2],

}

plot([{name : \"a\", x : objA.index, y : objA.arrPrice}, {name : \"b\", x : objB.index, y : objB.arrPrice}])Out[20]:

买好币上KuCoin:https://www.kucoin.com/r/af/1f7w3 CoinMarketCap前五的交易所,注册友好操简单快捷!

目前不清退的交易所推荐:

1、全球第二大交易所OKX欧意,邀请链接:https://www.myts3cards.com/cn/join/1837888 注册简单,交易不需要实名,新用户能开合约,币种多,交易量大!。

2、老牌交易所比特儿现改名叫芝麻开门 :https://www.gate.win/signup/649183

买好币上币库:https://www.kucoin.com/r/1f7w3